Why Minimum Payments Keep You in Debt Longer Than You Expect

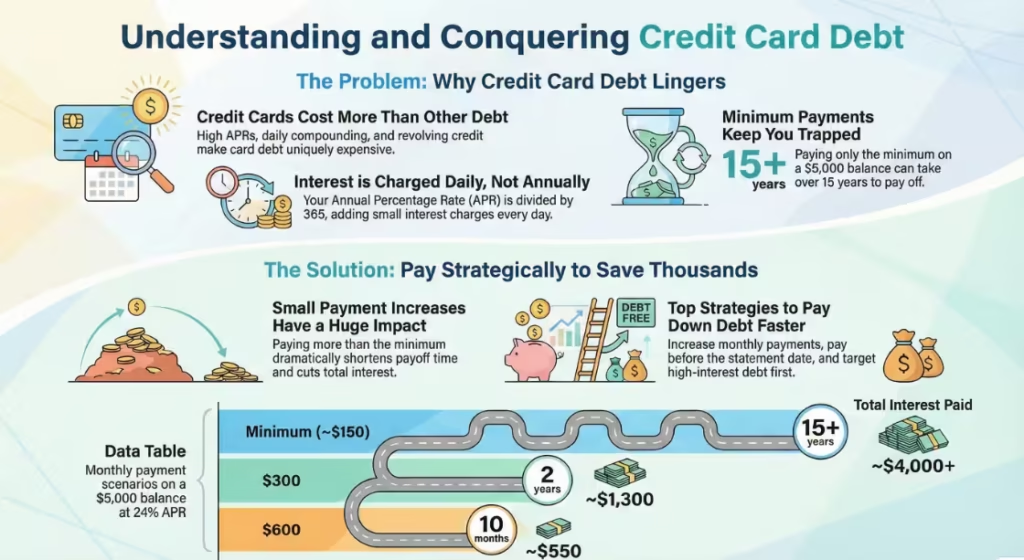

Minimum payments are designed to keep accounts current, not to eliminate debt quickly. They are usually calculated as a small percentage of the balance plus interest and fees. This structure means that early payments barely touch the principal. Most of the money goes toward interest, especially when balances are high. As a result, progress feels slow, and the balance declines at a crawl. Interest dominates early payments, which is why long repayment timelines are common. Issuers benefit from this structure through steady interest revenue, but the terms are disclosed and legal. The challenge is that many cardholders underestimate how long repayment will take. Without running the numbers, minimum payments appear harmless, even though they quietly extend debt for years.

How to Reduce Credit Card Interest and Pay Off Debt Faster

Reducing credit card interest requires a mix of planning, timing, and payment strategy. Small changes often have an outsized effect because interest compounds frequently. The goal is to reduce the balance quickly and limit how long interest can accumulate. This section focuses on practical steps that many people can apply without changing cards or taking on new loans. Each approach works best in specific situations, and understanding when to use them helps avoid mistakes.

Increasing Your Monthly Payment Strategically

Even modest payment increases can make a big difference. Adding $50 or $100 per month reduces interest and shortens payoff time more than most people expect. Early payments matter most because they lower the balance before interest has time to grow. This approach works well for people with steady income who want faster results without major changes to their financial setup.

Paying Before the Statement Closing Date

Paying before the statement closes lowers the balance used to calculate interest. This reduces the average daily balance and cuts interest charges for that cycle. Timing matters because interest is based on daily balances, not just the statement total. This strategy helps even if the total monthly payment stays the same.

Using Balance Transfers and Lower-APR Options

Balance transfers can reduce interest if the promotional rate is low and fees are reasonable. They work best when there is a clear payoff plan. Risks include transfer fees, short promotional periods, and higher rates after expiration. These options help when used carefully and avoided when they delay real repayment.

Debt Consolidation vs Snowball vs Avalanche Methods

Debt consolidation combines balances into one payment, often at a lower rate. The snowball method focuses on paying smaller balances first for motivation, while the avalanche method targets the highest interest rates first for savings. Each approach suits different personalities and financial situations.

Common Credit Card Interest Questions (FAQs)

How much is 26.99% APR on $3,000?

A 26.99% APR on a $3,000 balance equals about $809.70 per year in interest if the balance stays unchanged for 12 months.

Annual interest:

$3,000 × 0.2699 = $809.70

Monthly interest (approximate):

$809.70 ÷ 12 ≈ $67.48 per month

In reality, credit cards calculate interest daily, so the exact amount depends on daily balances and payment timing. If you only make minimum payments, the total interest paid over time will be much higher than this one-year estimate.

How do I calculate interest on my credit card?

Most credit cards use the average daily balance method.

Steps:

Convert APR to a daily rate:

APR ÷ 365

Multiply the daily rate by your daily balance.

Add daily interest charges over the billing cycle.

Example:

Over a 30-day cycle, interest ≈ $98.70

What is 6% interest on $10,000?

At 6% annual interest, $10,000 generates $600 per year in interest.

This is common for personal loans or mortgages, not credit cards. Credit cards usually charge much higher rates and compound more frequently.

What is a 24% interest rate on a credit card?

A 24% APR is considered high but common for U.S. credit cards.

$5,000 balance → about $1,200 per year in interest

$3,000 balance → about $720 per year in interest

At this rate, minimum payments mostly cover interest during the first years, which explains why balances decline slowly. Many mainstream cards now fall in the 20%–29% APR range, especially for average credit scores.

Is 29.99% APR too high?

Yes, 29.99% APR is extremely high, even by credit card standards.

It is usually associated with:

At this rate:

$3,000 balance ≈ $900 per year in interest

Long-term repayment can cost more than the original balance

Most financial advisors recommend avoiding carrying balances at this rate whenever possible.

What is the 2-3-4 rule for credit cards?

The 2-3-4 rule is a personal finance guideline, not a lender rule:

2 credit cards for everyday use

3 cards maximum to manage comfortably

4 cards or more may increase risk of overspending and missed payments

It helps control credit usage while maintaining a strong credit profile. The ideal number varies by discipline and income stability.

How can I avoid paying credit card interest?

You can avoid credit card interest by:

Paying the full statement balance by the due date

Using the grace period, which most cards offer

Paying early to lower the average daily balance

Avoiding cash advances and late payments

Once a balance is carried past the grace period, interest usually applies immediately until the balance is fully cleared.

How do you calculate interest per month?

A simple monthly estimate uses this formula:

Balance × APR ÷ 12

Example:

$4,000 × 0.18 ÷ 12 = $60 per month

Actual charges may differ slightly due to daily compounding and billing cycle length.

What is 5% interest on $5,000?

At 5% annual interest:

This rate is typical for savings accounts, CDs, or low-interest loans, not credit cards.

Is 22% interest high on a credit card?

Yes, 22% APR is high, but it is within the current market average.

At this rate, increasing monthly payments early can significantly reduce interest costs and shorten repayment time.

Limitations of Credit Card Interest Calculators

Credit card interest calculators provide estimates, not exact figures. They usually do not include annual fees, late fees, or penalty APRs. Statement timing differences and issuer-specific rules can also affect actual interest charges. Some cards use slightly different calculation methods or billing cycles. Calculators assume steady payments and no new purchases, which may not reflect real-life behavior. Despite these limits, calculators remain useful planning tools because they show trends, comparisons, and relative outcomes rather than exact cents.

Who Should Use a Credit Card Interest Calculator (And Who Shouldn’t)

These calculators are ideal for people planning debt payoff, comparing payment strategies, or setting realistic timelines. They help users understand how interest works and how behavior affects results. People facing severe financial stress, missed payments, or legal issues may benefit more from professional advice. Calculators also fall short when balances change frequently or when fees dominate costs. Knowing when estimates are enough and when expert guidance is needed helps users make informed choices.

Final Thoughts: Turning Credit Card Interest from a Mystery Into a Plan

Credit card interest feels confusing because it works quietly and adds up over time. A calculator turns that confusion into clear numbers and practical choices. By showing how payments, timing, and rates interact, it becomes a decision tool rather than a guessing game. Proactive strategies lead to faster payoff, lower costs, and greater control. With the right understanding and consistent action, credit card interest becomes manageable, predictable, and far less intimidating.