How Does This Inflation Calculator Work?

This inflation calculator works by applying established economic formulas and historical data to adjust money values over time. It offers both simple and advanced calculation methods to suit different needs. Understanding how the calculator works builds trust in its results and helps users interpret outputs correctly. Each method serves a specific purpose, depending on whether the user wants estimates or data-based accuracy.

How Does the Basic Inflation Calculator Calculate Future Value?

The basic inflation calculator uses a fixed annual inflation rate to estimate future value. It applies a compound growth formula where the inflation rate is added year after year. The calculation multiplies the initial amount by the inflation factor raised to the number of years. This method is simple and useful for projections or scenarios where historical data is not required. It helps users understand how steady inflation affects money over time. While it does not account for yearly fluctuations, it provides a clear and quick estimate that is easy to understand.

How Does the Advanced CPI-Based Calculator Work?

The advanced calculator uses Consumer Price Index data to calculate inflation more accurately. Instead of assuming a fixed rate, it compares CPI values from the start and end years. The ratio between these values reflects how prices have changed over that period. This method accounts for real historical inflation patterns, including years of higher or lower inflation. CPI-based calculations are especially useful for analyzing past values in today’s terms. They provide a more precise adjustment and are widely used by economists and financial analysts.

What Is the Difference Between Simple and CPI-Based Inflation Calculations?

Simple inflation calculations assume a constant rate, making them useful for estimates and future planning. CPI-based calculations rely on actual historical data, making them more accurate for past comparisons. The simple method is easier and faster, while the CPI method reflects real economic changes. Both approaches serve different purposes. Choosing the right method depends on whether the goal is projection or historical accuracy. Understanding this difference helps users select the calculation that best fits their needs.

What Information Do You Need to Use an Inflation Calculator?

Using an inflation calculator requires a few basic inputs. These inputs determine how the calculation is performed and how accurate the results are. Knowing what information to enter helps users avoid errors and interpret results correctly. Each input plays a specific role in adjusting money values over time.

What Amount of Money Should You Enter?

The amount entered should represent the value you want to adjust for inflation. This could be a past expense, income, savings amount, or price. It should be entered as a nominal value, meaning the original amount from that year. Accuracy matters, so rounding too much can affect results slightly. The calculator uses this amount as the base for adjustment. Entering realistic figures helps produce meaningful outcomes, especially for long-term comparisons.

What Start Year and End Year Should You Choose?

The start year is the year when the original amount applied, and the end year is the year you want to compare it to. Choosing correct years is critical for accurate inflation adjustment. A longer time gap increases the impact of inflation. For historical analysis, both years should have reliable inflation data available. Selecting appropriate years ensures that the calculator reflects real economic changes during that period.

What Inflation Rate Should You Use?

For simple calculations, the inflation rate should reflect an average or expected annual rate. Historical averages are often used for long-term planning, while lower or higher rates may suit specific scenarios. The chosen rate greatly influences results, especially over many years. Using realistic rates helps avoid overestimating or underestimating future costs. When unsure, historical averages provide a reasonable starting point.

What Is Compounding Frequency and Why Does It Matter?

Compounding frequency refers to how often inflation is applied within a year, such as annually or monthly. While annual compounding is common, more frequent compounding slightly increases the final adjusted value. Over short periods, the difference is small, but over long periods, it becomes noticeable. Understanding compounding helps users see how inflation builds over time. Choosing the correct frequency improves accuracy, especially in detailed financial analysis.

What Results Does the Inflation Calculator Show?

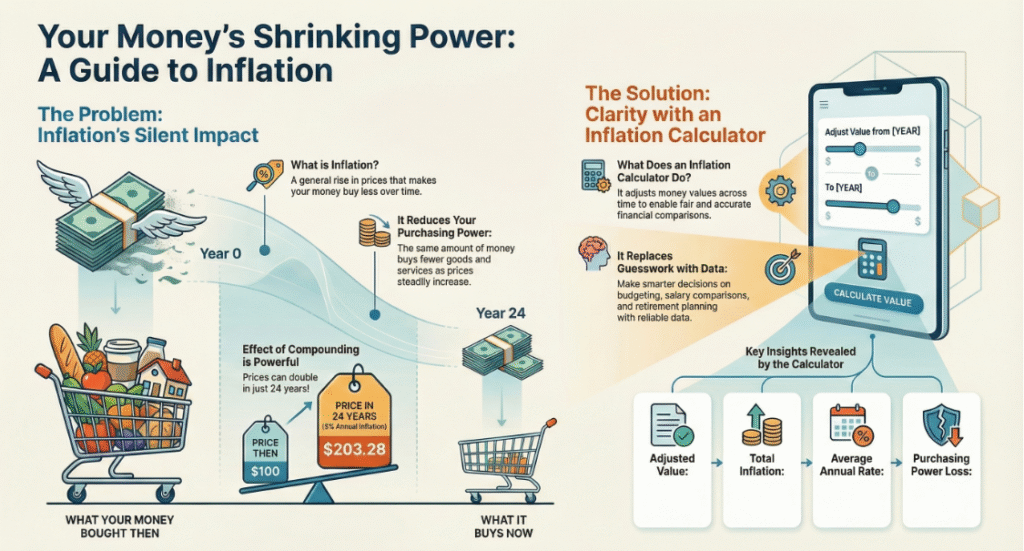

An inflation calculator provides clear and practical outputs that help users understand how money changes in value over time. Instead of showing raw numbers, it converts them into meaningful results that reflect real purchasing power. These results explain how much an amount grows due to inflation, how fast prices increase on average, and how much buying ability is lost. Each output answers a specific financial question and removes confusion caused by comparing values from different years. By presenting multiple results together, the calculator gives a full picture rather than a single number. This helps users make informed decisions about budgeting, saving, investing, and planning for the future using accurate, inflation-adjusted figures.

What Is the Inflation-Adjusted Future Value?

The inflation-adjusted future value shows how much a given amount of money would be worth after accounting for inflation over a specific period. It answers questions like what $1,000 from the past equals today or how much money will be needed in the future to match today’s value. This result reflects changes in price levels rather than investment growth. It is especially useful for comparing costs, salaries, or savings across different years. By adjusting for inflation, the future value reveals the true economic meaning of money over time. Without this adjustment, people often underestimate future expenses or misunderstand how much prices have increased.

What Does Total Inflation Percentage Mean?

Total inflation percentage represents the overall increase in prices between two points in time. It shows how much the cost of goods and services has risen during the selected period. For example, a total inflation rate of 80% means prices are nearly double what they were at the starting year. This result helps users understand the cumulative impact of inflation rather than focusing on year-by-year changes. Total inflation is useful for long-term comparisons and historical analysis. It highlights how even moderate inflation can lead to large changes over many years, making it easier to grasp the long-term effect on money value.

What Is Average Annual Inflation Rate?

The average annual inflation rate shows how fast prices increased per year on average over a given period. Instead of listing each year’s change, it smooths inflation into a single yearly rate. This helps users compare different time periods easily. For example, two decades may have similar total inflation but different annual rates. This rate is useful for planning and forecasting, as it gives a realistic yearly estimate of price growth. It is also helpful when projecting future costs or comparing inflation across countries or periods. Understanding this rate helps users see how inflation compounds gradually over time.

What Does Purchasing Power Loss Tell You?

Purchasing power loss shows how much value money has lost due to inflation. It explains how much less goods and services can be bought with the same amount over time. For example, a 40% purchasing power loss means money now buys only 60% of what it once did. This result is important because it connects inflation directly to daily life. It highlights why saving without growth can reduce financial strength. Purchasing power loss helps users understand why income increases do not always feel like progress and why inflation-aware planning is necessary for long-term stability.

What Is Purchasing Power and Why Does It Matter?

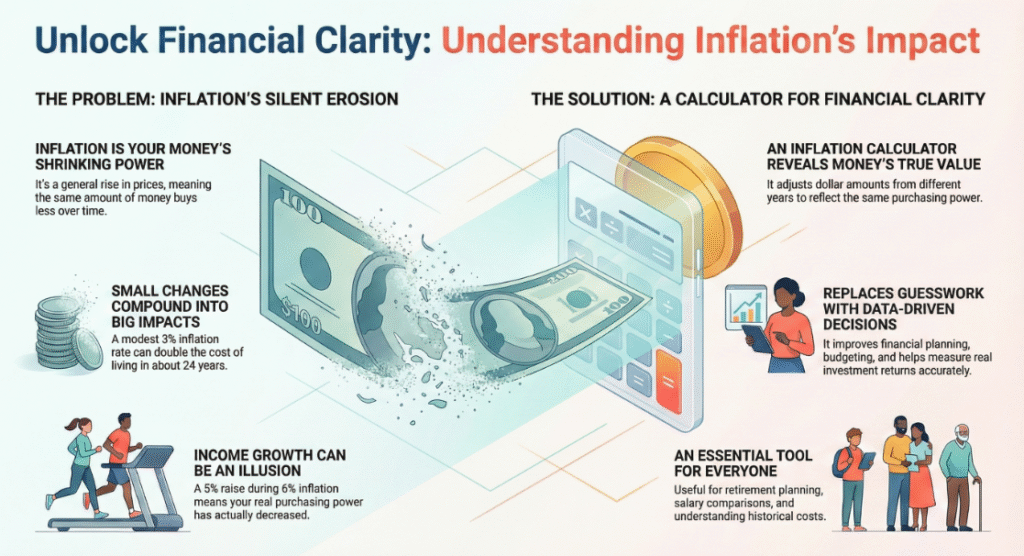

Purchasing power refers to what money can actually buy, not just how much of it you have. It is a practical way to measure real financial strength. While income and savings are often measured in numbers, purchasing power reflects lived experience. Inflation affects purchasing power by raising prices over time, which means the same amount of money buys less. Understanding purchasing power helps explain why prices feel higher even when income increases. It also highlights the importance of adjusting financial plans for inflation. Without considering purchasing power, people may assume they are doing better financially while actually losing ground in real terms.

What Is Purchasing Power?

Purchasing power is the amount of goods and services that can be bought with a unit of currency. When prices are low, purchasing power is high, and when prices rise, purchasing power falls. Purchasing power helps measure real wealth rather than nominal amounts. It explains why money from the past cannot be compared directly with money today. Purchasing power varies over time and can differ between regions and income groups. It is affected by inflation, wages, and price changes. Understanding purchasing power allows people to judge whether income growth is meaningful or simply keeping up with rising costs.

How Does Inflation Reduce Purchasing Power Over Time?

Inflation reduces purchasing power by increasing prices year after year. Even small annual increases can lead to large changes over time due to compounding. For example, a steady 3% inflation rate can cut purchasing power nearly in half over 25 years. This means savings that do not grow lose value in real terms. Inflation affects essentials like food, housing, and healthcare, which often rise faster than average prices. As a result, people may feel financial pressure even when income rises. Understanding this process helps explain why long-term planning must always include inflation adjustments.

How Is Purchasing Power Different From Income Growth?

Income growth refers to higher earnings over time, while purchasing power focuses on what those earnings can buy. Income can increase while purchasing power stays the same or even declines if inflation rises faster. For example, a 5% salary increase during 6% inflation still results in reduced purchasing power. This difference explains why higher pay does not always improve living standards. Purchasing power provides a clearer picture of financial progress. It shifts focus from numbers on a paycheck to real-life affordability. Comparing income growth without inflation adjustment often leads to misleading conclusions.

What Is the Consumer Price Index (CPI)?

The Consumer Price Index, or CPI, is one of the most widely used measures of inflation. It tracks changes in prices paid by consumers for a basket of common goods and services over time. Governments, businesses, and economists rely on CPI to understand inflation trends. CPI data helps adjust wages, pensions, and tax brackets. It also forms the foundation for many inflation calculators. Understanding CPI helps users trust inflation results and interpret them correctly. While CPI is not perfect, it remains the most recognized and accessible inflation measure for general use.

What Does CPI Measure?

CPI measures the average change in prices for a selected group of goods and services, including food, housing, transportation, healthcare, and education. This group represents typical household spending. Prices are collected regularly and compared over time to show inflation trends. CPI reflects urban consumer spending patterns and is updated to reflect changing habits. It does not track every price in the economy, but it provides a broad view of cost-of-living changes. CPI is expressed as an index number rather than a dollar amount, making it useful for comparisons across years.

How Is CPI Used to Calculate Inflation?

Inflation is calculated by comparing CPI values from different periods. The percentage change between two CPI figures represents inflation over that time. For example, if CPI rises from 200 to 220, inflation is 10%. Inflation calculators use this relationship to adjust money values accurately. CPI-based calculations reflect real price changes rather than assumed rates. This makes them reliable for historical comparisons. CPI data allows inflation to be measured consistently across long periods, which is why it is widely used in financial analysis and policy decisions.

Why Is CPI Considered the Standard Inflation Measure?

CPI is considered the standard inflation measure because it is consistent, transparent, and regularly updated. It is produced by official statistical agencies using established methods. CPI covers a wide range of consumer expenses and reflects real spending patterns. Governments use it to adjust benefits and wages, which reinforces its credibility. While other inflation measures exist, CPI remains the most familiar and accessible. Its long historical record also allows meaningful comparisons across decades, making it suitable for inflation calculators and long-term analysis.

What Are the Limitations of CPI?

CPI has limitations because it represents average spending, not individual experiences. Personal inflation rates may differ depending on lifestyle, location, and spending habits. CPI may not fully capture changes in product quality or new goods. It also focuses on urban consumers, which may not reflect rural costs. Housing and healthcare costs can rise faster than CPI suggests for some groups. Despite these limits, CPI remains a useful general measure. Understanding its limits helps users interpret inflation results realistically rather than treating them as exact personal outcomes.

What Formulas Are Used in Inflation Calculations?

Inflation calculators rely on mathematical formulas to adjust money values over time. These formulas ensure consistent and accurate results. They account for compounding, which is essential for understanding long-term inflation effects. Different formulas are used depending on whether a fixed rate or CPI data is applied. Understanding these formulas helps users trust the results and see how values are derived. While users do not need to calculate manually, knowing the logic behind the formulas improves financial awareness and transparency.

What Is the Future Value Inflation Formula?

The future value inflation formula calculates how much an amount grows due to inflation over time. It multiplies the original amount by one plus the inflation rate, raised to the number of years. This formula reflects compounding, where inflation builds year after year. It is commonly used for projections and planning. The formula assumes a constant rate, making it simple and easy to apply. While it does not reflect yearly fluctuations, it provides a clear estimate of inflation’s long-term effect on money value.

How Is Inflation Calculated Using CPI?

CPI-based inflation is calculated by dividing the CPI value of the end year by the CPI value of the start year. The result shows how much prices have changed over that period. This ratio is applied directly to the original amount to find its adjusted value. This method reflects real historical price changes rather than assumptions. CPI-based calculations are widely used for adjusting past values into present terms. They provide a realistic picture of inflation’s impact over time.

How Is Average Annual Inflation Calculated?

Average annual inflation is calculated by converting total inflation over a period into a yearly rate. This is done using a mathematical process that accounts for compounding. The result shows the constant rate that would produce the same total inflation over the period. This rate helps compare inflation across different time spans. It is useful for forecasting and analysis. Average annual inflation simplifies complex data into an understandable yearly figure.

How Accurate Is This Inflation Calculator?

The accuracy of an inflation calculator depends on data quality and calculation methods. A well-designed calculator uses reliable data sources and accepted formulas. While no calculator can predict future inflation perfectly, historical adjustments can be very accurate. Understanding accuracy helps users use results wisely. Inflation calculators provide estimates, not guarantees, but they are far more reliable than guesses or assumptions.

What Data Sources Are Used for Inflation Calculations?

Inflation calculators typically use official CPI data published by government statistical agencies. These data sets are updated regularly and reviewed for accuracy. CPI data covers many decades, allowing long-term comparisons. Using official sources ensures consistency and transparency. Reliable data forms the foundation of accurate inflation calculations. Without trusted data, results would be misleading.

How Reliable Are Historical Inflation Calculations?

Historical inflation calculations are highly reliable because they are based on recorded price data. While small revisions may occur, overall trends remain stable. CPI-based calculations accurately reflect how prices changed in the past. They are widely used in research, policy, and finance. Historical inflation results are suitable for analysis, planning, and comparison. Their reliability makes inflation calculators valuable tools.

Why Can Inflation Results Vary Between Calculators?

Inflation results can vary due to differences in data sources, base years, or calculation methods. Some calculators use average rates, while others use CPI data. The selected time period and compounding assumptions also affect results. Understanding these differences helps users compare outputs wisely. Variations do not mean calculators are wrong; they reflect different assumptions and methods.

What Are Some Real-World Inflation Examples?

Real-world examples help explain inflation’s impact clearly. By applying inflation adjustments to familiar amounts, users can see how prices and values change over time. Examples make abstract concepts easier to understand. They show why inflation matters in daily life and long-term planning.

How Much Is $100 From 2000 Worth Today?

A $100 amount from the year 2000 is worth significantly more today after adjusting for inflation. Prices have risen steadily over the past two decades. Inflation calculators show how much that $100 would equal now in purchasing power. This example highlights how money loses value over time. It also explains why past prices seem low compared to today’s costs. Adjusting historical amounts helps create fair comparisons.

How Does Inflation Affect Money Over 10, 20, or 30 Years?

Over longer periods, inflation has a stronger effect due to compounding. Even moderate inflation can double prices over 25 to 30 years. Inflation calculators show how costs rise over decades. This helps explain why long-term savings must grow to maintain value. It also shows why future expenses are often underestimated. Long-term examples highlight the importance of inflation-aware planning.

How Does Inflation Impact Retirement Savings?

Inflation reduces the real value of retirement savings over time. Fixed savings lose purchasing power if they do not grow faster than inflation. Retirement planning must account for rising living costs. Inflation calculators help estimate future expenses accurately. They show how much savings are needed to maintain a desired standard of living. Understanding inflation helps prevent shortfalls in retirement planning.

What Are the Benefits of Using an Inflation Calculator?

An inflation calculator offers clear benefits by turning abstract price changes into understandable numbers. It helps people see how money changes in value over time instead of relying on memory or assumptions. By adjusting amounts for inflation, users can compare prices, salaries, and expenses from different years fairly. This improves financial awareness and reduces mistakes caused by ignoring inflation. The calculator also saves time by doing complex calculations instantly and consistently. Whether used for personal budgeting, long-term savings, or business analysis, it provides clarity and confidence. Its biggest benefit is accuracy, as it replaces rough estimates with data-backed results. Over time, regular use builds better financial habits and helps users plan with realistic expectations rather than guesswork.

How Does an Inflation Calculator Help With Financial Planning?

An inflation calculator plays a key role in financial planning by showing how future costs may rise and how past money values compare to today. It helps planners avoid underestimating expenses such as housing, healthcare, and education. By adjusting amounts for inflation, users can set savings goals that reflect real future needs. This is especially important for retirement planning, where small errors can grow over decades. The calculator also helps assess whether income growth is truly improving financial position or simply keeping pace with rising prices. With clear inflation-adjusted figures, financial plans become more realistic, reducing the risk of shortfalls and helping users make informed long-term decisions.

How Does It Improve Budgeting and Forecasting?

Budgeting and forecasting depend on realistic assumptions, and inflation calculators improve both by adjusting numbers for rising prices. Instead of using today’s costs as fixed references, users can estimate how expenses may change over time. This is useful for long-term household budgets, education planning, or business cost forecasts. Inflation adjustment prevents budgets from becoming outdated quickly. It also helps identify which expenses may grow faster than income. By using inflation-aware projections, users can prepare for future price increases rather than reacting to them later. This leads to more stable financial management and fewer surprises caused by gradual but persistent price growth.

How Does It Support Better Investment Decisions?

Inflation calculators support investment decisions by showing real returns rather than nominal gains. An investment that grows 6% per year may seem strong, but if inflation is 4%, the real gain is much smaller. By adjusting returns for inflation, investors can compare options fairly. This helps identify investments that preserve or grow purchasing power. Inflation calculators also help assess long-term performance by removing price-level distortions. They make it easier to understand whether an investment is truly adding value or just keeping up with inflation. This clarity supports smarter asset allocation and more realistic expectations.

How Can You Protect Your Money From Inflation?

Protecting money from inflation means focusing on maintaining purchasing power rather than just preserving nominal value. Inflation gradually erodes the value of cash held without growth, so active strategies are often needed. Protection does not require extreme measures but does require awareness and planning. By understanding how inflation works, individuals can choose financial tools and habits that reduce its impact. This includes selecting appropriate investments, managing savings wisely, and understanding how inflation interacts with debt. While no strategy removes inflation entirely, thoughtful planning can reduce its effect and help money retain value over time.

What Types of Investments Typically Beat Inflation?

Some investments have historically grown faster than inflation over long periods. These often include stocks, real estate, and inflation-linked securities. Stocks can provide growth through earnings and dividends, which may rise with prices. Real estate often benefits from rising rents and property values. Inflation-protected bonds adjust payouts based on inflation measures. While these investments carry risk, they offer better protection than holding cash alone. Diversification across asset types can reduce risk while improving the chance of keeping pace with inflation. Understanding inflation-adjusted returns helps investors select options that support long-term purchasing power.

How Should Savings Be Managed During Inflation?

During inflation, savings should balance safety and growth. Keeping all savings in low-interest accounts can lead to value loss over time. While emergency funds should remain accessible, longer-term savings may benefit from higher-yield options. Regularly reviewing interest rates and inflation trends helps ensure savings strategies remain effective. Automatic contributions and periodic adjustments can also help maintain real value. Inflation calculators assist by showing how savings may change in purchasing power. Managing savings with inflation in mind helps protect financial stability while preserving flexibility.

How Does Inflation Affect Debt Over Time?

Inflation affects debt differently depending on its structure. Fixed-rate debt often becomes easier to manage over time because payments remain the same while income and prices rise. This reduces the real cost of repayment. Variable-rate debt, however, may become more expensive if interest rates increase in response to inflation. Understanding this difference helps borrowers make informed choices. Inflation calculators help evaluate the real burden of debt over time. Used wisely, inflation can reduce the real weight of certain debts, but poor planning can increase financial stress.

What Are the Limitations of Inflation Calculators?

Inflation calculators are helpful tools, but they have limits that users should understand. They rely on averages and assumptions that may not reflect individual experiences. Inflation varies by location, spending habits, and time period. Calculators also focus on price changes, not personal income or lifestyle changes. While they provide useful estimates, they cannot account for every factor affecting financial outcomes. Recognizing these limits helps users interpret results appropriately. Inflation calculators should inform decisions, not replace judgment or detailed financial analysis.

Why Is Personal Inflation Different From Average Inflation?

Personal inflation depends on individual spending patterns. Someone who spends more on healthcare or housing may experience higher inflation than the average. CPI-based calculators reflect general trends, not personal budgets. Regional differences also affect prices, causing variation across locations. As a result, personal inflation may be higher or lower than published averages. Inflation calculators provide a general guide, but users should adjust results based on their own expenses. Understanding this difference prevents overreliance on averages and encourages more customized planning.

Why Can Future Inflation Not Be Predicted Accurately?

Future inflation depends on many unpredictable factors, including economic growth, policy decisions, global events, and supply conditions. While trends and averages offer guidance, sudden changes can occur. Inflation calculators cannot forecast these shifts precisely. They rely on historical data or assumed rates, which may not hold in the future. This uncertainty is why inflation results should be viewed as estimates. Planning with flexibility helps manage this unpredictability. Inflation calculators provide direction, not certainty.

Why Should Inflation Calculators Be Used as Estimates?

Inflation calculators simplify complex economic behavior into usable numbers. While this makes them practical, it also means results are approximate. They do not capture individual circumstances or future changes. Using them as estimates encourages realistic planning without false confidence. Inflation calculators are best used as guides alongside other financial tools. Treating results as flexible helps users adapt plans as conditions change. This balanced approach maximizes usefulness while avoiding overconfidence.

How Is Inflation Different From Deflation and Stagflation?

Inflation is one of several economic conditions that affect prices and growth. Deflation and stagflation represent different patterns with unique effects. Understanding these differences helps clarify why moderate inflation is often preferred. Each condition influences spending, saving, and investment behavior in distinct ways. Comparing them provides context for why inflation management matters and how economic conditions shape financial outcomes.

What Is Deflation and How Does It Affect Consumers?

Deflation occurs when prices fall across the economy. While lower prices may seem positive, deflation often signals weak demand and slow growth. Consumers may delay spending, expecting prices to drop further. This can reduce business revenue and employment. Deflation increases the real value of debt, making repayment harder. It can lead to economic stagnation. Inflation calculators focus on inflation, but understanding deflation helps explain why stable price growth is often preferred by policymakers.

What Is Stagflation and Why Is It Risky?

Stagflation combines rising prices with slow economic growth and high unemployment. This condition is challenging because traditional policy tools may not work well. Consumers face higher costs without income growth, reducing purchasing power sharply. Businesses struggle with rising expenses and weak demand. Stagflation highlights the importance of monitoring inflation alongside growth. It shows that inflation alone does not determine economic health.

How Does Inflation Compare to Other Economic Conditions?

Inflation reflects rising prices during normal economic activity. Unlike deflation, it does not discourage spending, and unlike stagflation, it often occurs with growth. Moderate inflation supports wage adjustments and economic stability. Comparing inflation with other conditions shows why managing price growth matters. Inflation calculators help track inflation’s effect, but broader understanding helps interpret results within economic context.

How Should You Use an Inflation Calculator Correctly?

Using an inflation calculator correctly ensures results are meaningful and useful. This involves choosing appropriate inputs, understanding outputs, and avoiding common mistakes. Proper use turns the calculator into a powerful planning tool rather than a source of confusion. Awareness of assumptions improves interpretation and decision-making.

How Do You Choose the Right Inflation Rate?

Choosing the right inflation rate depends on purpose. Historical averages suit long-term planning, while recent trends may fit short-term analysis. Conservative estimates help avoid underestimating costs. Using realistic rates improves accuracy. Inflation calculators often allow flexibility, which should be used thoughtfully. Matching the rate to the situation helps produce useful results.

How Should Inflation Calculator Results Be Interpreted?

Results should be interpreted as adjusted comparisons, not predictions. They show how values change under certain assumptions. Understanding what each output represents helps avoid misreading results. Inflation-adjusted values reflect purchasing power, not investment growth. Viewing results as guides supports better decisions.

What Common Mistakes Should You Avoid?

Common mistakes include ignoring compounding, using unrealistic rates, or treating estimates as exact. Comparing nominal and adjusted values incorrectly can also mislead. Avoiding these errors improves accuracy. Careful input selection and thoughtful interpretation help users get the most from inflation calculators.

Frequently Asked Questions About Inflation Calculators

Inflation calculators raise common questions about accuracy, use, and interpretation. Addressing these questions helps users feel confident and informed. Clear answers improve understanding and reduce misuse. These questions reflect practical concerns shared by many users.

How accurate are inflation calculators?

Inflation calculators are accurate for historical adjustments when using reliable data. They provide strong estimates but are not exact for future projections. Accuracy depends on data quality and assumptions.

What is a normal or healthy inflation rate?

A moderate inflation rate, often around 2%, is considered healthy by many economies. It supports growth without rapid price erosion.

Does inflation affect everyone equally?

No, inflation affects people differently based on spending habits, income sources, and location. Personal experiences vary.

Can inflation ever be negative?

Yes, negative inflation, or deflation, occurs when prices fall. It is less common and often linked to economic weakness.

Should I use past inflation to predict future costs?

Past inflation provides guidance, but future conditions may differ. It is useful for planning but not guaranteed.

Is This Inflation Calculator Free to Use?

Accessibility is important for financial tools. Many inflation calculators are offered without cost to encourage broad use. Free access supports financial education and awareness. Understanding usage terms helps users know what to expect.

Most inflation calculators do not require sign-up. They are available for immediate use, making them convenient and accessible.

Some calculators allow commercial use, while others are limited to personal use. Checking terms ensures appropriate usage.

What Should You Know Before Relying on Inflation Calculations?

Inflation calculations provide valuable insight but should be used thoughtfully. Understanding their role and limits helps avoid misinterpretation. They support planning but do not replace professional advice.Inflation calculators provide informational results, not personalized advice. They do not account for individual goals or risk tolerance.

A financial professional can tailor advice to personal circumstances. They consider inflation alongside income, assets, and goals for balanced planning.

Why Is Understanding Inflation Essential for Your Financial Future?

Understanding inflation helps protect purchasing power and improve long-term decisions. It explains why money values change and why planning must adjust over time. Awareness supports realistic goals and financial confidence.