Role of Recurring Investments

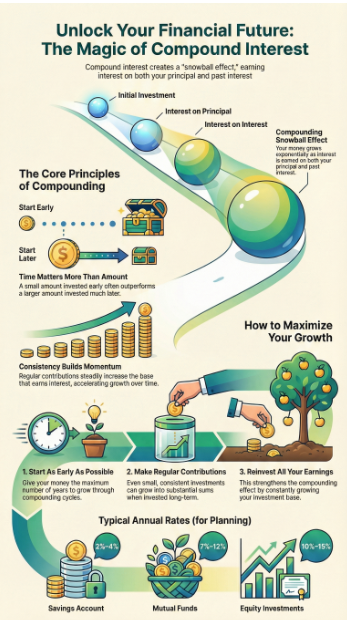

Recurring investments play a key role in building wealth because they create consistency and discipline. Each recurring amount adds to the investment base and increases the total balance that earns interest. This approach works well for salaried individuals who prefer investing part of their income regularly. Over time, recurring investments can contribute more than the initial amount invested. They also reduce the impact of short-term market changes by spreading investments across different periods. This steady approach helps maintain progress even during uncertain times and supports long-term financial planning through regular and manageable contributions.

SIP-Style Investing Explanation

SIP-style investing involves investing a fixed amount at regular intervals, usually monthly. This method works well with compound interest because each contribution has time to grow. SIP-style investing removes the pressure of deciding when to invest and supports consistent habits. It also helps manage risk by averaging investment costs over time. As contributions accumulate, compound interest begins working on both the invested amount and the returns earned earlier. Over long periods, SIP-style investing can produce strong results even with modest contributions. This approach is widely used for retirement planning and long-term wealth creation.

How Does Time Influence Compound Interest Growth?

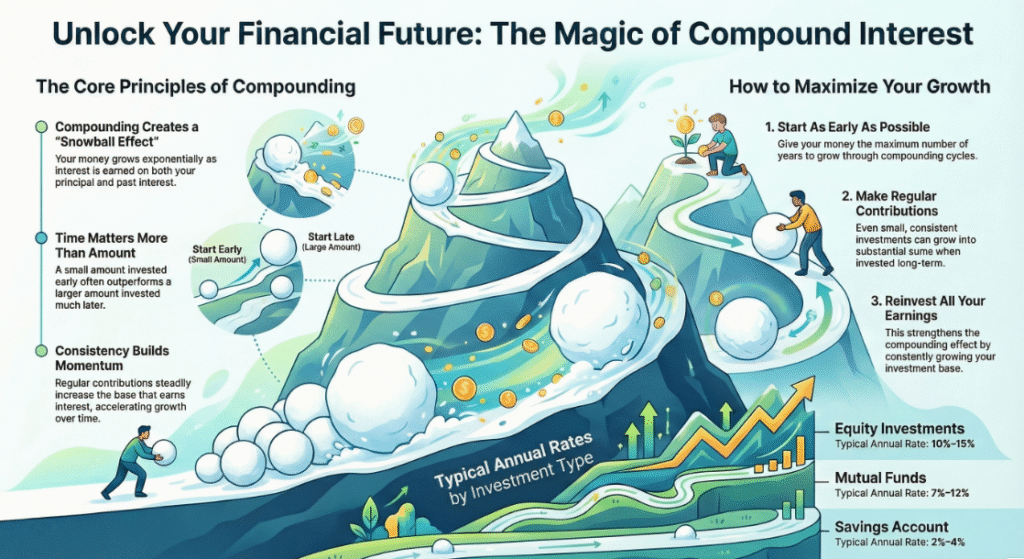

Time is the most important factor in compound interest growth because it allows interest to repeat its cycle many times. Each additional year gives interest more chances to grow on previous earnings. The effect of compounding becomes more visible in later years as growth speeds up. Short-term investing limits this effect, while long-term investing maximizes it. Time reduces the need for higher contributions or risky strategies. People who invest early often achieve better results with less effort. This makes time a valuable resource in financial planning and highlights the importance of patience and long-term commitment.

Early vs Late Investing

Early investing allows compound interest to work longer, which leads to higher growth. Even if the invested amount is small, starting early gives interest more time to build. Late investing requires higher contributions to achieve similar results because there are fewer compounding periods. This difference shows why early action is beneficial. Someone who invests early can often invest less overall and still achieve better outcomes. Late starters may feel pressure to invest more aggressively. Understanding this difference helps people prioritize starting early and staying consistent rather than waiting for ideal conditions.

Compounding Acceleration Over Years

Compound interest grows slowly at first, but over time the growth rate increases. This acceleration happens because interest is calculated on a growing balance. In early years, returns may seem small, which can test patience. However, as years pass, interest earnings increase faster than contributions. This stage is where compound interest shows its true strength. The longer the investment continues, the stronger this acceleration becomes. Understanding this pattern helps investors stay committed during early stages and avoid withdrawing funds too soon. Long-term patience allows compounding to deliver meaningful financial results.

What Inputs Are Required to Calculate Compound Interest?

To calculate compound interest accurately, a few key inputs are required. These inputs define how money grows and help produce realistic estimates. Each input plays a specific role in the calculation process. By adjusting these values, users can test different scenarios and plan accordingly. Common inputs include the starting amount, monthly contributions, interest rate, duration, and compounding frequency. Together, these details create a complete picture of potential growth. Understanding each input helps users make informed choices and avoid unrealistic expectations. Clear input selection ensures that results are useful for planning and comparison.

What Is the Initial Investment Amount?

The initial investment amount is the money invested at the beginning of the investment period. It forms the base on which compound interest starts working. This amount immediately begins earning interest and continues to grow over time. A higher initial amount can lead to higher returns, but it is not the only factor that matters. Even a small starting amount can grow well if given enough time. The initial investment sets the foundation for future growth and influences how quickly compounding begins. Choosing a realistic starting amount helps create accurate projections and achievable financial goals.

Definition

The initial investment amount refers to the first sum of money invested before any interest or contributions are added. It represents the starting point of the investment journey. This amount may come from savings, bonuses, or other funds set aside for long-term goals. Once invested, it earns interest based on the chosen rate and compounding schedule. The calculator treats this amount as the first contribution and uses it to calculate growth from the beginning. Understanding this definition helps users enter correct values and interpret results properly.

Impact on Final Value

The initial investment amount directly affects the final value because it starts earning interest earlier than later contributions. A larger starting amount can produce higher returns due to longer exposure to compounding. However, the impact becomes even stronger when combined with time and regular contributions. While increasing the initial amount helps, starting early often matters more. This balance shows that both timing and amount influence results. Users can test different starting amounts in the calculator to see how early investments compare with higher but delayed investments.

What Are Monthly Contributions and Why Do They Matter?

Monthly contributions are regular amounts added to the investment during the investment period. They help grow the total balance steadily and allow compound interest to apply to new funds. These contributions reduce reliance on a large initial investment and support long-term consistency. Monthly contributions matter because they add momentum to growth and increase total invested capital. Over time, they can exceed the initial investment in value. This approach suits people who prefer manageable investments rather than large one-time deposits. Monthly contributions also support disciplined investing habits and long-term planning.

Consistency Advantage

Consistency gives compound interest time to work smoothly and steadily. Regular monthly contributions ensure that money is added even during periods of uncertainty. This habit reduces emotional decision-making and supports steady progress. Over long periods, consistent investing often leads to better outcomes than irregular investing. Each consistent contribution adds to the base that earns interest. This creates a stable growth pattern and reduces dependence on market timing. Consistency supports financial discipline and helps investors stay focused on long-term goals rather than short-term changes.

Small Amount vs Long Duration

A small monthly amount invested over a long duration can outperform a larger amount invested for a short time. Duration allows compound interest to repeat its growth cycle many times. Small contributions benefit from time and consistency, which often matter more than size. This principle encourages people to start investing early, even with limited funds. Over long periods, interest earned can surpass the total amount invested. Understanding this relationship helps investors avoid delaying investments and focus on building habits rather than waiting for larger amounts.

Expected vs Guaranteed Returns

Expected returns are estimates based on historical performance or assumptions. They are not guaranteed and can change due to market conditions. Guaranteed returns are fixed and offered by specific financial products. Most long-term investments offer expected returns rather than guarantees. The calculator uses expected rates to project growth. Users should understand that real outcomes may differ. This distinction helps prevent unrealistic expectations and supports responsible financial planning. Using conservative estimates often produces more reliable projections.

Typical Rate Ranges

Typical interest rate ranges vary by investment type. Savings accounts may offer lower rates, while long-term investments often aim for higher returns. Common estimated ranges include:

Investment Type | Typical Annual Rate |

Savings Account | 2%–4% |

Bonds | 4%–6% |

Mutual Funds | 7%–12% |

Equity Investments | 10%–15% |

These ranges help users select realistic values for planning purposes.

What Is the Investment Duration in Years?

Investment duration refers to how long money remains invested. It is measured in years and plays a major role in compound growth. Longer durations allow interest to repeat more times, which increases total returns. Short durations limit compounding and reduce growth potential. Duration also influences risk tolerance and strategy. Long-term investments often handle short-term changes better. Selecting an appropriate duration helps align investments with goals such as retirement or education planning.

Time Horizon Importance

The time horizon determines how much growth compound interest can achieve. A longer horizon allows returns to build gradually and steadily. It reduces pressure to chase high returns and supports stable planning. Short horizons may require higher contributions or higher risk. Understanding time horizon importance helps investors choose suitable strategies and remain patient. It also highlights the benefit of starting early and staying invested.

Long-Term Compounding Effect

Long-term compounding increases growth because interest keeps building on a growing balance. Over many years, this effect becomes stronger and more noticeable. Early patience leads to later rewards. The long-term effect explains why investments often grow faster in later years than in early years. This pattern supports long-term commitment and discourages early withdrawals.

What Is Compounding Frequency and How Does It Affect Returns?

Compounding frequency refers to how often interest is applied to the investment. Common frequencies include yearly, quarterly, monthly, or daily. More frequent compounding can slightly increase returns because interest is added more often. However, the effect is smaller compared to time and consistency. Understanding frequency helps users interpret results correctly and choose realistic expectations.

Meaning of Compounding Frequency

Compounding frequency defines how many times interest is added during a year. Monthly compounding means interest is applied twelve times. Each application increases the balance slightly. This repeated addition helps returns grow steadily. Frequency works alongside interest rate and duration to influence results.

Conceptual Impact on Growth

Higher compounding frequency increases growth by applying interest more often. However, the difference becomes meaningful mainly over long durations. While daily compounding sounds attractive, monthly compounding often produces similar results in practical scenarios. Understanding this prevents overemphasis on frequency alone.

Clarification of Calculator Assumptions

This calculator assumes regular monthly compounding and consistent contributions. It does not include taxes, inflation, or fees. Results are estimates for planning and comparison. Understanding these assumptions helps users use results responsibly.

What Does the Year-by-Year Investment Breakdown Mean?

The year-by-year investment breakdown explains how your investment grows at each stage over time instead of showing only a final result. It breaks the total investment period into individual years and displays how much you started with, how much you contributed during the year, how much interest was earned, and the ending balance. This detailed view helps you understand when growth is slow and when it begins to accelerate. It also shows how interest gradually becomes a larger part of the total value. By reviewing the yearly breakdown, you can track progress, compare different investment plans, and identify the impact of consistency and time. This clarity makes long-term planning easier and helps users stay confident and committed to their investment strategy.

Can You See an Example of a Compound Interest Calculation?

An example helps turn abstract numbers into something easy to understand. Suppose you invest money regularly and want to know how it grows over time. A compound interest calculation example shows exactly how interest and contributions work together. By seeing sample inputs, monthly growth, and the final result, users can relate the calculation to their own situation. This makes it easier to trust the results and adjust values confidently. Examples also help beginners understand why long-term investing matters more than short-term gains. Instead of guessing outcomes, users can see a clear picture of how steady investing and time combine to produce growth. This section bridges the gap between theory and real financial planning.

What Are Sample Inputs in a Compound Interest Calculation?

Sample inputs represent realistic values that many investors might use. For example:

Input Type | Sample Value |

Initial Investment | $10,000 |

Monthly Contribution | $500 |

Annual Interest Rate | 7% |

Investment Duration | 10 years |

Compounding Frequency | Monthly |

These inputs reflect a common long-term investment approach. They show how someone with moderate income can invest consistently without large one-time deposits. Using sample inputs allows users to compare their own situation easily. It also helps them understand which inputs matter most. By adjusting these values, users can test different strategies and see how small changes affect long-term outcomes.

What Are the Benefits of Using a Compound Interest Calculator?

Using a compound interest calculator provides clarity and structure for financial planning. It removes guesswork and replaces assumptions with visible outcomes. People often underestimate how small contributions grow over time, and the calculator corrects this misunderstanding. It helps users test ideas, compare scenarios, and plan realistically. By showing growth visually and numerically, it builds confidence and encourages consistency. The calculator also saves time by doing calculations instantly. Instead of relying on rough estimates, users get clear projections. These benefits make the calculator useful for beginners and experienced investors alike, supporting smarter and more disciplined financial decisions.

How Does a Compound Interest Calculator Provide Financial Clarity?

Financial clarity comes from seeing where money goes and how it grows. The calculator separates contributions from interest, making growth easy to understand. Users can see how much effort they put in and how much growth comes from time and interest. This clarity helps avoid unrealistic expectations and confusion. Clear results support better planning and reduce stress. When people understand their numbers, they feel more confident about their choices. Financial clarity also helps users communicate goals more clearly with advisors or family members. Seeing clear outcomes makes financial planning feel manageable instead of uncertain.

How Does a Compound Interest Calculator Help With Goal Planning?

Goal planning becomes easier when future values are visible. The calculator allows users to set a target and adjust inputs to reach it. For example, users can increase monthly contributions or extend duration to meet a savings goal. This trial-and-error approach helps identify realistic plans. It also shows trade-offs, such as investing longer versus investing more. By linking actions to outcomes, the calculator turns goals into achievable steps. This structure supports long-term planning for education, retirement, or major purchases. Clear goals backed by calculations increase motivation and follow-through.

How Does Scenario Comparison Improve Decision-Making?

Scenario comparison allows users to test multiple strategies side by side. They can compare different interest rates, contribution amounts, or durations. This helps answer questions like “What if I invest more?” or “What if I start later?” Comparing scenarios highlights which changes have the biggest impact. It also helps users choose safer or more comfortable plans. Instead of relying on assumptions, users can see actual projected differences. Scenario comparison supports informed decisions and reduces regret. It encourages careful planning rather than impulsive choices, which is important for long-term financial stability.

How Does a Compound Interest Calculator Support Investment Discipline?

Investment discipline improves when progress is visible. The calculator shows how regular contributions lead to growth, reinforcing good habits. When users see long-term benefits, they are less likely to stop investing early. The calculator also highlights the cost of skipping contributions or withdrawing funds. This feedback encourages consistency and patience. Discipline is easier to maintain when results are clear and measurable. Over time, disciplined investing often produces better outcomes than irregular investing. The calculator acts as a reminder of long-term goals and the importance of staying committed.

Who Should Use a Compound Interest Calculator?

A compound interest calculator is useful for anyone planning to grow money over time. It suits people at different stages of life and income levels. Whether someone is new to investing or experienced, the calculator provides value. It adapts to different goals and helps users understand how time and consistency affect outcomes. Because it is simple to use, it does not require financial expertise. This broad usefulness makes it a helpful tool for planning, learning, and decision-making across many situations.

Why Is a Compound Interest Calculator Useful for Beginners?

Beginners often feel unsure about investing and financial planning. The calculator simplifies concepts and shows clear outcomes. It helps beginners understand how interest works without complex math. By adjusting inputs, beginners can learn through experimentation. This builds confidence and reduces fear of mistakes. The calculator also encourages early investing by showing long-term benefits. For beginners, seeing growth visually makes abstract ideas easier to grasp. This understanding helps them form good habits early and avoid common errors caused by lack of knowledge.

Why Do Long-Term Investors Benefit From a Compound Interest Calculator?

Long-term investors use the calculator to refine strategies and stay focused. It helps them test assumptions and adjust plans as goals change. Long-term investing relies on patience, and the calculator reinforces this by showing growth over years. Investors can evaluate whether current contributions are enough or need adjustment. The calculator also helps compare conservative and aggressive scenarios. For long-term investors, it serves as a planning and review tool that supports consistency and realistic expectations.

Why Should Retirement Planners Use a Compound Interest Calculator?

Retirement planning depends heavily on time and compound growth. The calculator helps estimate future savings and identify gaps. Retirement planners can test different contribution levels and retirement ages. This helps create realistic plans and reduce uncertainty. By visualizing growth, planners can see whether they are on track. The calculator also highlights the benefit of starting early. For retirement planning, this tool supports informed decisions and long-term preparation.

Why Are Students and Professionals Ideal Users?

Students and professionals often invest small amounts while building careers. The calculator shows how even modest contributions can grow over time. This encourages early planning and responsible habits. Professionals can use it to balance income, expenses, and investments. Students can learn basic financial principles through practical examples. For both groups, the calculator offers education and planning in one place. This early exposure supports better financial choices later in life.

Why Should You Use This Compound Interest Calculator Instead of Others?

This calculator stands out because it focuses on realism and clarity. It uses monthly calculations, which reflect real investing habits. It also combines visual and detailed outputs, making results easy to understand. The interface is simple, and results are easy to review and share. These features make it practical for everyday use rather than theoretical learning. Choosing the right calculator improves planning accuracy and user confidence.

How Does Realistic Monthly Simulation Improve Accuracy?

Monthly simulation matches how investments usually work. Contributions and returns are applied regularly, not once a year. This improves accuracy and realism. Users can see steady growth and understand how monthly habits affect outcomes. This approach avoids misleading results that come from oversimplified formulas. Realistic simulation builds trust and supports better planning decisions.

Why Are Visual and Tabular Outputs Helpful?

Visual charts show growth trends quickly, while tables provide detailed breakdowns. Together, they serve different learning styles. Charts highlight long-term patterns, and tables explain yearly changes. This combination improves understanding and supports analysis. Users can spot trends and review details easily.

How Does an Easy-to-Use Interface Improve User Experience?

A simple interface reduces confusion and errors. Clear labels and organized sections make input easy. This encourages users to explore scenarios without frustration. Ease of use supports frequent use and better planning.

Why Are Print-Friendly Results Useful?

Print-friendly results allow users to save or share plans. This is useful for discussions with advisors or family. Printed summaries support review and long-term tracking.

What Are the Limitations of a Compound Interest Calculator?

While useful, a compound interest calculator has limitations. It relies on assumptions and estimates. It cannot predict market changes or personal circumstances. Understanding these limits helps users use results responsibly. The calculator should guide planning, not replace professional advice.

What Assumptions Are Made in the Calculation?

The calculator assumes consistent contributions and a fixed interest rate. It also assumes regular compounding. These assumptions simplify planning but may not reflect all situations. Users should understand these limits.

What Factors Are Not Included in the Calculation?

Important factors not included are:

- Taxes

- Inflation

- Investment fees

- Market fluctuations

These factors affect real outcomes and should be considered separately.

What Common Mistakes Should You Avoid When Using a Compound Interest Calculator?

Using a compound interest calculator can be very helpful, but mistakes in assumptions can reduce its value. Many users expect perfect accuracy without understanding how inputs affect results. Common errors often come from impatience, overconfidence, or misunderstanding how compounding works. Some people enter unrealistic numbers, while others ignore important real-life factors. These mistakes can lead to poor planning or false confidence.

Why Are Unrealistic Return Expectations a Problem?

Unrealistic return expectations can distort financial planning and create disappointment. Many users assume very high annual interest rates without considering risk or market conditions. While higher rates look attractive, they may not reflect real investment performance. When actual results differ, users may feel discouraged or lose trust in investing. Reasonable estimates help create plans that are achievable and stable. Conservative assumptions often lead to better long-term outcomes because they reduce emotional reactions. Using realistic rates also helps compare options more accurately. A calculator works best when inputs reflect practical expectations rather than ideal scenarios.

Why Should You Not Ignore Inflation?

Inflation reduces the real value of money over time. Ignoring inflation can make future amounts appear more valuable than they actually are. For example, a large sum years later may buy less than expected if prices rise steadily. When users ignore inflation, they may overestimate purchasing power and set goals that fall short in real terms. Considering inflation helps create more realistic plans. While the calculator does not adjust for inflation automatically, users should keep it in mind when interpreting results. Awareness of inflation supports better planning and helps protect long-term financial goals.

Why Is Stopping Investments Early Harmful?

Stopping investments early reduces the benefits of compound interest. The early years of investing may show slow growth, but later years often bring faster gains. When investments stop too soon, compounding does not have enough time to build momentum. This can significantly lower the final value. Many people stop investing during uncertain periods, missing long-term growth. Consistency matters more than timing. Staying invested allows interest to keep building on previous earnings. Understanding this helps users remain patient and committed, even when progress feels slow in the beginning.

How Does Misunderstanding Compounding Affect Results?

Misunderstanding compounding often leads to impatience and poor decisions. Some users expect quick growth and feel disappointed when early returns seem small. This misunderstanding can cause them to stop investing or change plans too often. Compounding works gradually, and its strongest effects appear over time. Knowing how interest builds helps users stay focused on long-term goals. When people understand that growth accelerates later, they are more likely to stay consistent. Clear understanding reduces frustration and supports disciplined investing.

How Can You Maximize the Benefits of Compound Interest?

Maximizing compound interest depends more on habits than on large amounts of money. Simple actions, repeated consistently, create strong results over time. Starting early, staying consistent, and avoiding unnecessary withdrawals all support growth. Compound interest rewards patience and discipline rather than short-term decisions. Users who understand this focus on long-term progress instead of quick gains. A calculator helps test strategies, but real benefits come from applying those strategies consistently. Small improvements in habits can make a meaningful difference in outcomes over many years.

Why Should You Start Early?

Starting early gives compound interest more time to work. Even small amounts invested early can grow significantly over long periods. Time allows interest to repeat many times, which increases total growth. Delaying investments reduces the number of compounding cycles and limits potential returns. Early investing also reduces pressure to invest large amounts later. This approach supports steady planning and lower stress. Starting early builds good habits and allows gradual progress. The earlier the start, the greater the advantage from time alone.

Why Should You Increase Contributions Gradually?

Gradually increasing contributions helps improve growth without causing financial strain. As income grows, increasing investments allows more money to benefit from compounding. This approach is easier to maintain than sudden large increases. Gradual growth supports sustainability and consistency. Over time, these increases can significantly boost final outcomes. This method also adapts to changing financial situations. Increasing contributions slowly helps maintain balance between current needs and future goals.

Why Is Staying Invested Important?

Staying invested allows compound interest to continue working. Frequent withdrawals interrupt growth and reduce long-term results. Market changes may cause short-term uncertainty, but long-term investing smooths these effects. Staying invested requires patience and confidence in long-term planning. Those who remain invested often benefit from recovery periods and continued compounding. Staying invested supports stability and reduces emotional decision-making. This habit is essential for maximizing long-term growth.

Why Should You Reinvest Earnings?

Reinvesting earnings increases the total amount that earns interest. When earnings remain invested, they become part of the base for future growth. This strengthens compounding and accelerates results over time. Reinvesting avoids the temptation to withdraw early gains. It supports long-term planning and increases final value. This simple choice can make a significant difference over many years.

Is This Compound Interest Calculator Accurate and Safe to Use?

This compound interest calculator provides accurate estimates based on the inputs provided. It uses consistent calculation logic and regular compounding assumptions. Results update instantly as inputs change, helping users explore scenarios easily. The calculator does not collect or store personal information. All calculations run locally, which supports privacy and safety. While results are estimates, they are reliable for planning and comparison. Transparency and simplicity make the tool safe and trustworthy for everyday use.

How Is Accuracy Ensured?

Accuracy is ensured through consistent formulas and clear assumptions. The calculator applies interest regularly and tracks contributions step by step. Inputs directly determine outputs, allowing users to control results. While real investments may vary, the calculation method remains stable and predictable. This makes the tool useful for planning and comparison.

How Is Data Privacy Protected?

Data privacy is protected because the calculator does not store or transmit user information. All calculations occur locally in the browser. No personal or financial data is saved or shared. Users can explore scenarios without concerns about data security. This design supports safe and private usage.

Why Is There No Financial Advice Provided?

The calculator offers estimates, not personalized advice. Financial decisions depend on individual goals, risk tolerance, and circumstances. Professional guidance considers factors beyond simple calculations. The calculator supports learning and planning but does not replace expert advice.

Frequently Asked Questions About Compound Interest Calculator

This section answers common questions in clear and simple terms. These answers help users understand concepts quickly and confidently. FAQs address both beginners and experienced users. They clarify expectations and correct common misunderstandings.

What Is Compound Interest in Simple Words?

Compound interest means earning interest on both the money you invest and the interest earned earlier. Over time, this helps money grow faster.

How Is Compound Interest Different From Simple Interest?

Simple interest applies only to the original amount. Compound interest grows on the total balance, including previous interest.

Is Monthly Compounding Better Than Annual Compounding?

Monthly compounding applies interest more often, which can slightly increase growth over long periods.

Can This Calculator Be Used for Retirement Planning?

Yes, it helps estimate long-term savings and test contribution strategies for retirement planning.

Does This Calculator Guarantee Investment Returns?

No, it provides estimates only. Actual returns may differ based on real conditions.

What Happens If I Stop Monthly Contributions?

Growth continues on the existing balance, but the final value will be lower. Contributions strongly affect results.

How Long Should I Stay Invested to See Compounding Benefits?

Longer durations show stronger benefits. Ten years or more usually highlights compounding clearly.

How Can You Start Using Compound Interest to Build Wealth Today?

You can start using compound interest to build wealth today by taking simple, practical steps rather than waiting for the perfect moment. The first step is to begin with whatever amount you can afford, even if it feels small. Compound interest rewards time and consistency more than large one-time investments. Once you start, commit to regular contributions, such as monthly investments, so your money keeps growing steadily. Use a compound interest calculator to test different scenarios and understand how changes in time, contribution amount, or interest rate affect your results. Focus on long-term goals, avoid frequent withdrawals, and allow your earnings to remain invested. By starting early, staying consistent, and reviewing your progress periodically, you give compound interest the opportunity to work in your favor and support steady, long-term wealth growth.